- Blog

- Dec 13

AI Lunch and Learn with Erez Saf and Natalie Rens

By Rubia Kamal

Dr. Natalie Rens and Erez Saf were special guests at the “AI Lunch and Learn Workshop” hosted by the Digital and Innovation Team from the Bank of Queensland (BOQ) with the goal to introduce Artificial Intelligence (AI) to the bank employees in an interesting and appealing approach including thinking games and understanding the foundations of AI.

Dr. Natalie Rens is the AI specialist at the Office of the Queensland Chief Entrepreneur, is a Doctor of Philosophy, Neural Dynamics of Voluntary Decision Making and is the founder of Brisbane.AI.

Erez Saf is the Founder and CEO of CRiskCo (a Fintech/Insuretech startup), holds an M.B.A from Tel Aviv University, was the CIO at eloan.co.il which was the first P2P Lending startup in Israel and has worked for many years in the startup community.

The BOQ team kicked off the session by asking Dr. Natalie to introduce the concept of AI and it’s significance. She answered by separating AI into three levels; Artificial Intelligence, Machine Learning and Deep Learning.

AI is so closely modeled to align with human thought patterns and abilities whilst improving speed, efficiency and volume of decisions. AI has been proven to outperform humans at many specialist tasks and is only limited by the availability of relevant data to be processed. Common known use cases for AI are autonomous cars, speech recognition, interpreting images and videos and strategic game systems. The fact is that AI is already applied extensively already with applications such as Facebook identifying people in images to be tagged and Banks notifying customers when abnormal transactions take place. AI helps us to do repetitive and somewhat mundane tasks whilst using the repetition to adapt and improve as more transactions are processed. On the flip side, the same repetition is proven to lead to error or boredom when processed by humans.

Erez then talked to the group about the applications for AI in Finance such as insurance, fraud detection, asset management, predictive finance and credit scoring (CRiskCo’s service).

Humans have long dreamed of the ability to predict the future, and now with AI, it is possible to do this by analyzing and learning from historical data such as Bank’s notifying you if your current behaviour is an anomaly to the past. Humans can use AI to make better decisions, and this is precisely the objective of the CRiskCo solution which uses prior companies behaviour to calculate credit risk and critically predict potential defaults before they occur. CRiskCo is able to significantly reduce the costs of processing financial data using AI, which makes it now feasible for Finance companies to service loans to small to medium companies.

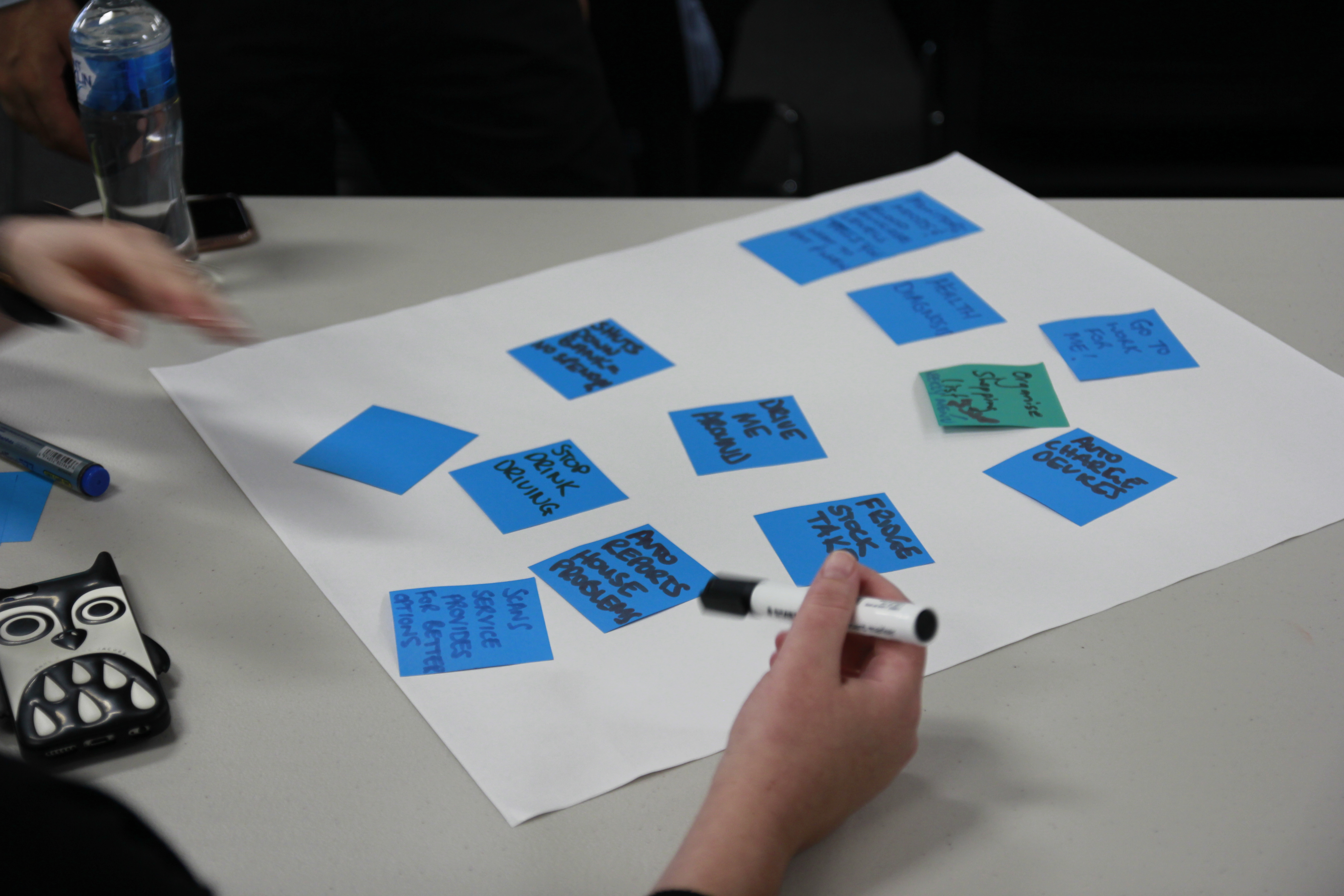

The workshop started with the participants asked to come up with ideas we can improve our lives and the bank processes using AI. After coming with more than 8 ideas per team, they ware asked to review their suggestions answering 3 major questions that AI developers face:

- Does it answers the three foundations of AI?

- There are one or two defined outcomes

- There are supporting parameters to the outcomes

- We can obtain a big sample size

- “How should we classify the data and the problem?”

- Supervised/ unsupervised

- Machine Learning (ML)\ Natural Language Processing (NLP) \ Speach\ Vision

- “What data do we need to solve the problem and how we can get it?”.

Overall, the event was surprisingly new and refreshing to many participants in the room. The link between the human brain and the AI technology was astonishing as one could see that humans cannot wander far from the invention of nature – AI is closely modeled to the real workings of the human brain and gives you a sense that the computer is truly making decisions on its own.

A number of interesting topics were raised once the floor was opened up for questions. Many were concerned that biases in AI can lead to sexism, racism and unfair verdicts and Erez and Dr. Natalie took the opportunity to explain that the biases only occur due to human biasses and the selection of features to be analyzed by the machine. Erez gave an example of using AI in predicting from the audience who would be Fortune 500’s next top CEO – If we would provide gender as one of the features to be analyzed by the algorithm, there would be almost no likelihood of a female participant being chosen by the AI and this is simply due to the history of Fortune 500 not having many females, remembering that AI prediction relies heavily on past data and doesn’t count for different context or social changes.

As innovation in AI continues, one thing is for sure – the technology is still very reliant on human input. People are still hesitant to put all decision making processes solely into the algorithms for AI – the technology lacks the “human touch” that we so often use in evaluating situations case by case. I learnt so much from the session and can’t wait to see how this technology develops in the future!

Cheers!

Rubia Kamal

Related Posts

Case Study: Imagina Leasing’s Improved Credit Decisions

Executive Summary Imagina Leasing, a leader in Mexico’s leasing industry, was on a mission to enhance the precision and security of its credit evaluations. Facing challenges in verifying financial documents and managing risks, they turned…

- Nov 14

Strengthen Risk Management with the New Financial Suppliers Tab

We’re thrilled to unveil an exciting update to our UI! Introducing the “Financial Suppliers” tab, now available on the company reports page and in the SAT information report. Know Your Competition and Past Financing Deals…

- Jul 29

Recent Posts

Subscribe

Join our newsletter and stay up to date!