- Case Study News

- Nov 18

🚀 Case Study: IRM Leasing’s Success with CRiskCo

Executive Summary

In the competitive financial world, where precision and trust are key, IRM Leasing decided to transform its credit evaluation processes. Partnering with CRiskCo, they reached new levels in fraud detection and accelerated their decision-making, setting a higher standard of security in Mexico’s leasing sector. 🇲🇽

💬 “Integrating CRiskCo into our evaluation process has been transformative. We now operate with greater precision and security, allowing us to make informed decisions, which is crucial in today’s financial environment.” — Sergio Salinas, Risk Director at IRM Leasing

🔍 The Challenge

As a leader in the leasing market, IRM Leasing faced the challenge of accurately assessing the financial health of its clients, especially in an environment where some applicants inflated figures to get better terms. They needed a solution to enhance their evaluations and detect discrepancies with official SAT data.

🎯 The Solution: Transforming Credit Evaluations with CRiskCo

1. Enhanced Fraud Detection

Leveraging CRiskCo’s technology, IRM Leasing was able to compare clients’ financial statements with verified tax records, identifying inflated sales and other irregularities for more reliable evaluations.

2. Improved Decision Accuracy

With verified data and CRiskCo’s FinScore, IRM Leasing enhanced the precision of their credit assessments, empowering their team to make better-informed, lower-risk decisions.

3. ⚡ Faster Approvals

The integration of CRiskCo eliminated the need to request financial statements directly, enabling IRM Leasing to speed up approvals and improve service agility.

4. Efficient Data Management

CRiskCo’s export-to-Excel feature allowed IRM Leasing to efficiently organize years of historical data, facilitating deeper financial analysis and strategic insights.

5. Comprehensive Client Evaluations

With tools like compliance opinions and tax certifications, CRiskCo provided IRM Leasing with a detailed view of clients’ fiscal responsibility, enabling more secure, well-rounded decisions.

Conclusion: Innovation for Reliable Growth

The partnership between IRM Leasing and CRiskCo demonstrates how technology can transform credit evaluation, raising standards of security and reliability in the financial sector. This collaboration has allowed IRM Leasing not only to improve their decision-making but also to strengthen their position in Mexico’s leasing market.

“At CRiskCo, we believe innovation is the key to unlocking potential across all industries. Our partnership with IRM Leasing shows how technology can expand access to capital and set new standards for transparency and security. We are proud to drive this transformation in Mexico’s financial sector.” — Erez Saf, CEO of CRiskCo

______________________________

About CRiskCo

CRiskCo is a leading provider of credit risk assessment solutions, offering financial institutions real-time access to verified tax data (SAT). Our innovative platform empowers businesses to make reliable, data-driven decisions, reduce risks, and optimize their credit evaluation processes.

About IRM Leasing

IRM Leasing is a respected financial institution in Mexico specializing in tailored leasing solutions for a variety of industries. Committed to excellence and customer satisfaction, IRM Leasing leads the way in providing secure, reliable financial services focused on the unique needs of the leasing sector.

This case study highlights how IRM Leasing, with the support of CRiskCo, is setting new standards of security and reliability in the leasing industry, demonstrating the power of innovation and collaboration in finance.

For any questions or inquiries, feel free to contact us at contact@criskco.com.

Related Posts

An Open Letter to Mexico’s Small Business Community

By Erez Saf – Pymes Capital and CRiskCo CEO, at Mexico Business News Dear Small and Medium Business Owners, Securing financing is critical for growth, yet many business owners and CFOs miss out on these…

- Nov 25

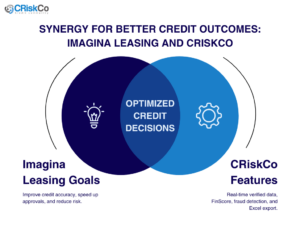

Case Study: Imagina Leasing’s Improved Credit Decisions

Executive Summary Imagina Leasing, a leader in Mexico’s leasing industry, was on a mission to enhance the precision and security of its credit evaluations. Facing challenges in verifying financial documents and managing risks, they turned…

- Nov 14

Recent Posts

Subscribe

Join our newsletter and stay up to date!