Introduction:

“Constancia de Situación Fiscal” (FISCAL) document, is generated during the initial registration of any company with SAT. Updates of this document are made exclusively when any of its values undergo a change. FISCAL offers the company’s primary identifiable information as well as records of its tax filings and company ID.

Index

- Datos de Identificación del Contribuyente (Taxpayer Identification Data)

- Datos del domicilio registrado (Registered address information)

- Actividad Económica (Economic activity)

- Regímenes (Regimes)

- Obligaciones (Obligations)

- Fiscal data in the DB

- Fiscal data in the dashboard

- Fiscal data in SAT report file

Datos de Identificación del Contribuyente (Taxpayer Identification Data) table:

This table serves as the company’s identification, containing data that defines both the company itself and its current status.

| RFC: | The company tax identification number | |

| Denominación/Razón Social (Name/Company Name): | Company name | |

| Régimen Capital (Capital Regime): | Company type | |

| Nombre Comercial (Tradename): | Company name + company type [Denominación/Razón Social+ Régimen Capital] | |

| Fecha inicio de operaciones (Operations start date): | Company establishment date | |

| Estatus en el padrón (Status in the register): | Company status in SAT (can be active / not active) | |

| Fecha de último cambio de estado (Date of last status change): | The date when the file was last modified. As was already indicated, the file is only updated when one of the contents is modified |

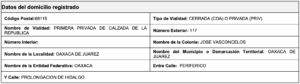

Datos del domicilio registrado (Registered address information) table:

Within this table, you will find the complete address of the company

| Código Postal (ZIP Code): | The zip code of the company’s location | |

| Tipo de Vialidad (Type of Road): | The type of street where the company is located (regular street / boulevard) | |

| Nombre de Vialidad (Road Name): | The street name of the company’s location | |

| Número Exterior (Outside Number): | Building number | |

| Número Interior (Interior number): | The office number inside the building | |

| Nombre de la Colonia (Colony Name): | The neighborhood’s name, located inside the town | |

| Nombre de la Localidad (Town Name): | The name of the town, located inside the Municipality or Territorial Demarcation | |

| Nombre del Municipio o Demarcación Territorial (Name of the Municipality or Territorial Demarcation): | The name of the Municipality or Territorial Demarcation, located inside the state | |

| Nombre de la Entidad Federativa (Name of the Federative Entity): | The name of the state, located inside Mexico | |

| Entre Calle (Between Street): | The street intersecting the street where the company is situated, either from the right or left direction (the specific direction of the intersection is unknown) | |

| Y Calle (And Street): | The other street that intersecting the street where the company is situated, either from the right or left direction (the specific direction of the intersection is unknown) |

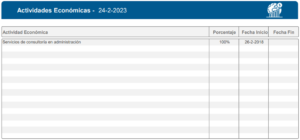

Actividad Económica (Economic activity) table:

This table provides a chronological record of the company’s history of industrial activities

| Actividad Económica (Economic activity): |

| This column state the name and details of the industrial activity |

| Porcentaje (Percentage): | This column specifies the proportion of the industry activity in relation to the company’s overall activities | |

| Fecha Inicio (Start Date): | The day the company first engaged in the activity | |

| Fecha Fin (End Date): | The day the company stop engaging in the activity |

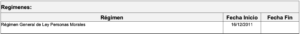

Regímenes (Regimes) table :

This table provides a chronological record of the company’s history of tax types. The regime is determined by company type and its economic activity.

| Régimen (Regime): | Specific taxes’ types that the company pays | |

| Fecha Inicio (Start Date): | The first date that the company started paying the tax type | |

| Fecha Fin (End Date) | The date on which the company ceased its obligation to pay the tax type |

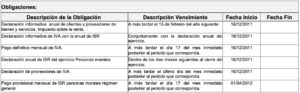

Obligaciones (Obligations):

This table provides a chronological record of the company’s history of tax types obligations for VAT (Value Adding Tax) and income tax. The regime of the company contains only and all the obligations in this table. The obligations are determined by company type and its economic activity

| Descripción de la Obligación (Obligation Description): | Specific types of tax obligations that the company pays | |

| Descripción Vencimiento (Description Expiration): | The final date by which the company must submit the required documents for the designated tax obligations to SAT | |

| Fecha Inicio (Start Date): | The first date that the company started paying the type of tax obligations | |

| Fecha Fin (End Date): | The date on which the company ceased its obligation to pay the specified tax obligation type |

The date showing when the file was downloaded from SAT can be found at:

The first page:

The last page:

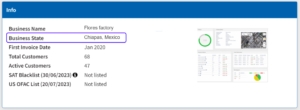

Data sourced from the CÉDULA DE IDENTIFICACIÓN FISCAL file within the system:

Reports page -> Info section

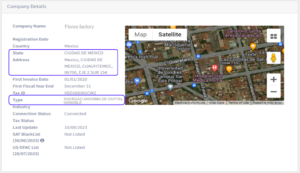

Company page -> Company details section

Data sourced from the CÉDULA DE IDENTIFICACIÓN FISCAL file within the SAT company report:

Detalles de la Empresa (Company Details) Page 1. The data sourced from the file is marked in the blue box.

Actividades Económicas (economic activity) page 3. Display the complete table of economic activities extracted from the file.

Related Posts

An Open Letter to Mexico’s Small Business Community

By Erez Saf – Pymes Capital and CRiskCo CEO, at Mexico Business News Dear Small and Medium Business Owners, Securing financing is critical for growth, yet many business owners and CFOs miss out on these…

- Nov 25

🚀 Case Study: IRM Leasing’s Success with CRiskCo

Executive Summary In the competitive financial world, where precision and trust are key, IRM Leasing decided to transform its credit evaluation processes. Partnering with CRiskCo, they reached new levels in fraud detection and accelerated their…

- Nov 18

Recent Posts

Subscribe

Join our newsletter and stay up to date!