- Blog

- May 12

Small-Medium Business Equipment Financing Options

Looking to expand your business? Purchase a new kitchen for your restaurant? New server? Many SMEs worry about this scenario. Whether replacing a crucial asset or expanding a business and taking it to the next level, this can be a challenging financial process. So how can equipment finance step in to support your operational expansion and growth?

In this article, CRiskCo has analysed what equipment financing is and the process your business can take to apply and get approval in a matter of hours, not weeks.

What Is Equipment Financing?

Equipment financing is a loan given to a business by a lender to acquire business-related equipment. Equipment loans are offered for a specific period, which includes principal and interest repayments. The loan is secured using the equipment as collateral against your loan. Once the loan is paid, the equipment’s ownership turns to the business free of any lien or claim.

It is also important to note that some equipment types may require an additional guarantee other than equipment; this may imply that the lender may impose some other assets of the business as an encumbrance until the debt is paid.

Why would your SME consider Equipment Financing?

It is a common challenge for small and medium businesses to face growth when specific essential equipment is needed to take the company to the next development phase. In many cases, the equipment is expensive and requires a significant investment or cash outlay.

Using current equity for this purchase can compromise your cash flow, thus hampering day-to-day operations. When you acquire new equipment, machinery or tools, there may be additional expenditure required to set up the latest equipment. This can also put a strain on cash flow and the budget.

For example, in a manufacturing environment, you may have to test functionality and streamline your processes. Larger machinery may require site modifications, electrical infrastructure changes and staff training. If you are simply replacing outdated or broken-down equipment, then perhaps additional staff training might be all that is required.

In most instances, additional costs are associated with purchasing business equipment. For a small business, these added expenses can blow the budget. To avoid placing a strain on your current financial resources, business equipment financing spreads the asset’s cost out over time. Just as your assets’ depreciation can be written off or amortised over their useful life, financing can also have a favourable tax and cash flow effect.

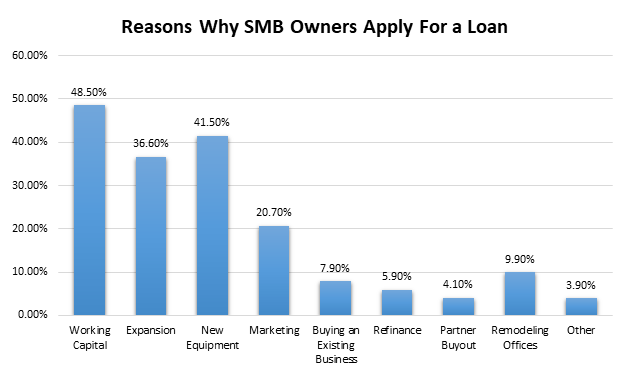

The data below shows that second to working capital requirements, SMEs note that equipment finance is one of the main reasons they apply for a loan.

Types of assets that can be funded by equipment finance

Equipment financing covers various equipment that any business may require to facilitate its operations. Depending on the business needs, the following are some of the everyday items that are financed using this loan:

- Trucks, delivery vehicles and other company vehicles,

- Data processing equipment,

- Computers, digital equipment such as printers and other general office equipment,

- Medical and diagnostic equipment,

- Restaurant refrigeration, ovens, coffee machinery and equipment,

- Farm machinery and tools,

- Manufacturing and industrial plant and equipment.

Types of Equipment Financing

There are various types of equipment finance that every SME business should explore and analyse to determine its suitability for your business needs. The following four main types of financing differ from each other in terms of ownership of the equipment, i.e., whether you or the lender owns the equipment.

- Chattel Mortgage

In the chattel mortgage agreement, your business acquires the equipment right from the start. Your SME needs to maintain the payments as stipulated by the loan terms. Because this is a mortgage in nature, where the business defaults in paying, the lender may take possession of the equipment.

As an example, suppose your small business is a restaurant and you are expanding by opening a new facility is another suburb. You require equipment to establish this location, items such as refrigeration and ovens, which can be costly for a single outlay. You take out equipment finance, borrowing 80% of the funds. You use available equity to fund the remaining 20%. As your business opens the new venue, your operations then fund the loan. Your business pays off the loan over the term – leaving you with ownership of the equipment.

- Finance lease

Under this type of financing, the lender buys the equipment and lends it to your business. The agreement is that your SME will pay off the equipment under the lease’s terms with a final payment transferring ownership from the lender to the SME. The business effectively rents the machinery and eventually makes payments towards total ownership over an agreed time.

- Operating lease

Like a finance lease, the lender owns the equipment, so the business rents it. However, in the case of an operating lease, there is no agreement that your business intends to acquire the equipment at the end of the lease, meaning that the lender solely owns the equipment.

- Consumer Hire Purchase

Hire-purchase allows the lender to acquire the equipment and then lend it to your business. As agreed in the hire-purchase terms, the company pays for the equipment until the end of the agreed period. After the final payment, the equipment is then fully acquired by the business.

SME Equipment Finance – We make it easy

As described above, there are various routes that your business can use to acquire equipment and methods to finance it.

Whether you are looking to own the equipment outright or have the option to purchase it at a later date, there are options available to you. For SME financing solutions for equipment loans, consider using a solution like CRiskCo.

Technology has eased the ways business access financial lenders. By assessing your financial metrics, we can help you get the best financing by matching your business needs with the lenders’ requirements.

For equipment finance, customer concentration ratios and balance sheet strength may come into play as the lenders assess how exposed you are to changes in circumstances and, therefore, your ability to repay the loan. This can take some time to evaluate through traditional methods of lending. If you are looking for a quick turnaround and want to know if you would be successful with your loan application, turn to CRiskCo.

Using CRiskCo Direct, your business can fast-track its access to equipment finance. Our platform brings the lender closer to you by offering comprehensive support that simplifies SME business finance approval with responsible lenders. Your credit score is not affected throughout the application, and the connection to your accounting system is safe and secure.

If you require equipment financing, worry no more. Connect to our platform and immediately engage with lenders at criskco.com.

Related Posts

Case Study: Imagina Leasing’s Improved Credit Decisions

Executive Summary Imagina Leasing, a leader in Mexico’s leasing industry, was on a mission to enhance the precision and security of its credit evaluations. Facing challenges in verifying financial documents and managing risks, they turned…

- Nov 14

Strengthen Risk Management with the New Financial Suppliers Tab

We’re thrilled to unveil an exciting update to our UI! Introducing the “Financial Suppliers” tab, now available on the company reports page and in the SAT information report. Know Your Competition and Past Financing Deals…

- Jul 29

Recent Posts

Subscribe

Join our newsletter and stay up to date!